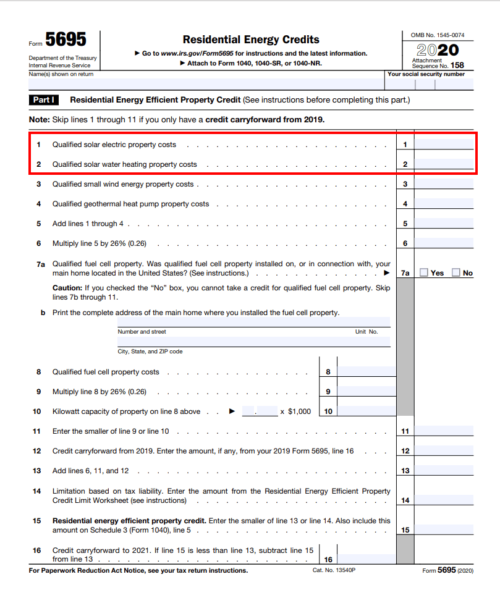

The federal solar tax credit allows you to deduct a percent of the cost of installing a solar energy system from your federal taxes.

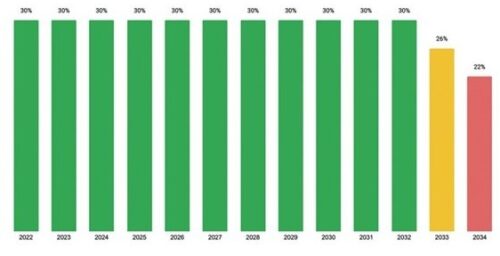

The Inflation Reduction Act of 2022 has extended and increased the Federal Solar Tax Credit from 26% to 30% for the next 10 years. All systems installed from 2022-2032 will be eligible for the 30% tax credit.